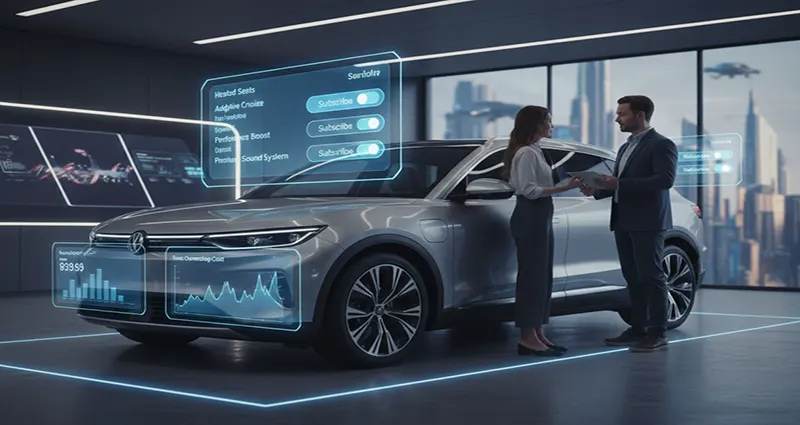

Imagine driving your new car off the lot, only to realize that the heated seats you see in the cabin require a £15 monthly fee to actually get warm. Or perhaps you’re cruising down the motorway and a notification pops up on your dashboard offering a “Performance Boost” for a one-time weekend fee of £30.

By 2026, this is no longer a dystopian projection; it is the “Software-Defined Vehicle” (SDV) reality. The automotive industry is undergoing its most significant business model shift since the invention of the assembly line, moving from a “one-and-done” sales transaction to a recurring “Features on Demand” (FoD) subscription economy.

The Shift from Hardware to “Hedge-Fund” Engineering

For decades, car manufacturers (OEMs) made their money selling physical hardware. If you wanted leather seats or a better sound system, you paid for the “Luxury Pack” at the point of purchase. Today, manufacturers are increasingly building every car with the same high-end hardware already installed, then using software to “lock” or “unlock” those features.

Why is this happening?

- Manufacturing Efficiency: It is cheaper for a brand like BMW or Audi to install heated seat coils in every car they build than it is to manage 50 different wiring harness variations on the assembly line.

- Continuous Revenue: Traditional car sales are cyclical and low-margin. Subscriptions provide a “sticky” revenue stream that lasts for the entire 10-to-15-year lifespan of the vehicle.

- Resale Value Control: By allowing second and third owners to subscribe to features the original buyer didn’t want, manufacturers can keep the “perceived value” of used cars higher.

The Consumer Paradox: Flexibility vs. “Nickel-and-Diming”

The rise of subscription features has sparked a fierce debate among drivers. While industry reports from 2025 indicated that nearly 70% of shoppers were skeptical of paying for features their car already physically possesses, the market is finding a middle ground through “Try Before You Buy” models.

The “Pros” for the Modern Driver:

- Lower Entry Price: In theory, a “blank” car can be sold at a lower base price, allowing you to pay only for the features you need when you need them (e.g., subscribing to “Snow Mode” only for a skiing trip).

- Freshness: Over-the-air (OTA) updates mean your car can literally get faster or smarter while it sits in your driveway.

- Try Before You Buy: Many brands now offer 30-day free trials for semi-autonomous driving or premium navigation, reducing the risk of wasting money on tech you don’t like.

The “Cons” and Hidden Costs:

- Subscription Fatigue: Between Netflix, Spotify, and gym memberships, many families are hitting a financial wall. Adding a “Car Features” bill is a tough pill to swallow.

- The “Double Pay” Argument: Critics argue that if a car costs £45,000, the physical components of the heated seats are already built into that price—meaning the subscription fee is essentially a “ransom” for your own hardware.

- Resale Complexity: If you sell your car, do the “unlocked” features stay with the vehicle, or are they tied to your personal account? This remains a grey area in 2026.

Impact on Total Cost of Ownership (TCO)

The financial math of owning a car is changing. In 2026, a “cheap” car might end up being more expensive over five years than a premium model once you factor in the “Digital Tax.”

| Ownership Model | Initial Cost | Monthly “Feature” Fees | 5-Year Estimated TCO |

| Traditional (Fixed) | High (£50k) | £0 | £62,000 (Incl. Maint) |

| Subscription-Heavy | Medium (£42k) | £85 (Avg. Bundle) | £64,100 (Incl. Maint) |

| Full Usership (MaaS) | £0 (Deposit) | £650 (All-in) | £39,000 |

Note: “MaaS” (Mobility-as-a-Service) is the most extreme version of this trend, where you don’t own the car at all; you subscribe to the entire vehicle, including insurance and maintenance.

The Future: “Mobility-as-a-Service” (MaaS)

As the lines between owning and subscribing blur, many analysts predict that by 2030, private car ownership in urban areas could drop by up to 80%. Instead of a 4-year lease, consumers are gravitating toward 6-to-12-month “all-inclusive” subscriptions.

In this future, you don’t worry about depreciation, insurance, or tires. You pay a single monthly fee for access to a fleet. Need an SUV for a weekend in the Lake District? Swap your compact city car for a 7-seater via an app. This “usership” model is becoming the preferred path for Gen Z and Millennial drivers who view cars as a utility rather than an identity.

Navigating the New Showroom

The era of “buying a car and being done with it” is fading. As we move further into 2026, the car is becoming a “smartphone on wheels,” and your relationship with the manufacturer will be a lifelong subscription. To stay ahead, consumers must look past the “sticker price” and calculate the Digital TCO—the cost of the software required to make that hardware actually work.