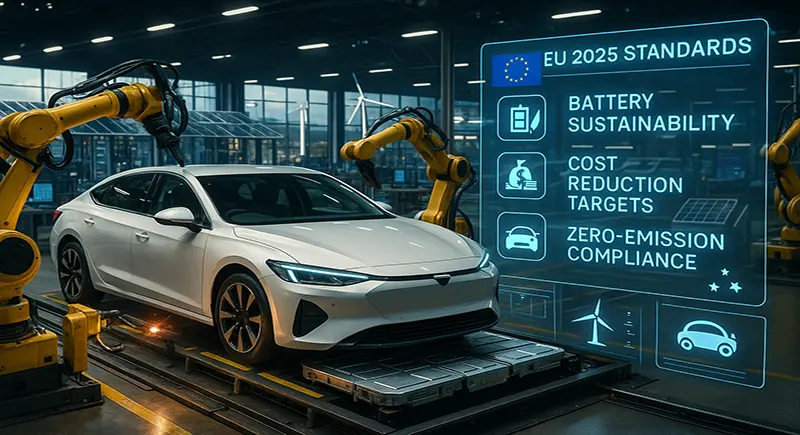

The European Union’s ambitious climate goals—to achieve carbon neutrality by 2050—rest heavily on the mass adoption of electric vehicles (EVs). However, widespread uptake is currently hampered by the barrier of high initial purchase costs for many consumers. In response, the EU has employed a two-pronged strategy: punitive emissions targets to force manufacturers to produce more EVs, and systemic regulations to drive down long-term production costs. This article details the critical EU legislative actions aimed at boosting affordability by 2025 and examines the policy challenges in meeting these goals.

The Legislative Context: CO2 Targets and the ICE Phase-Out

The overarching legislative framework is the commitment to phase out new sales of internal combustion engine (ICE) vehicles by 2035. This hard deadline creates existential pressure on automakers. More immediately, the EU imposes stringent CO2 emission reduction targets for automakers’ average fleet sales.

The next major reduction stage is 2025, which requires a 15% reduction in average fleet emissions compared to 2021 levels. Manufacturers who fail to meet their specific targets face substantial financial penalties (fines of €95 per gram of CO2 over the target, per vehicle sold). This economic threat forces automakers to aggressively push zero-emission vehicles (ZEVs) like EVs into their sales mix. Since volume is the key to lowering production costs (through economies of scale), the threat of billions in fines effectively incentivizes manufacturers to sell more, cheaper EVs, even if initial margins are compressed, in order to avoid the catastrophic compliance costs.

The Critical Enabler: The Batteries Regulation

While CO2 targets create demand, the EU Batteries Regulation (entering critical implementation phases around 2025) is the policy engine designed to secure long-term affordability through sustainability and supply chain efficiency. This regulation addresses the single biggest factor in EV cost: the battery.

The regulation’s purpose is to ensure batteries placed on the EU market are sustainable and circular throughout their lifecycle, which fundamentally ties sustainability to cost-reduction. Key aspects include:

| O | Mandatory Due Diligence (starting 2025/2027): Manufacturers must establish systems for the ethical sourcing of critical raw materials like lithium and cobalt. |

| O | Mandatory Recycled Content (starting 2031): Setting minimum recovery and reuse percentages for key materials. |

| O | The Digital Battery Passport (starting 2027): A digital record storing data on carbon footprint, material composition, and origin. |

By standardizing battery design, mandating recycled content, and creating a transparent circular economy framework, the regulation intends to reduce the industry’s dependence on volatile global virgin raw material markets. This supply resilience and resource recovery will eventually lead to lower, more stable input costs, which are essential for manufacturing truly affordable, mass-market EVs.

Addressing Infrastructure & Market Barriers

Affordability isn’t only about the car’s price; it’s also about user confidence. A major non-cost barrier to mass adoption is “range anxiety”—the fear of running out of charge before finding a station. The Alternative Fuels Infrastructure Regulation (AFIR) directly tackles this.

AFIR sets mandatory deployment targets for charging infrastructure across EU Member States. Specifically, by 2025, high-power charging stations (at least 150 kW) must be installed every 60 km along the main Trans-European Transport (TEN-T) network.

By guaranteeing widespread, reliable public charging infrastructure, AFIR reduces driver apprehension, which accelerates consumer acceptance. This in turn drives higher EV sales volume, indirectly enabling manufacturers to achieve the economies of scale needed to make production more affordable. Furthermore, while the EU generally prohibits government aid that distorts competition (EU state aid rules), Member States are allowed to implement national subsidy schemes (e.g., direct purchase incentives or production support) under specific, reviewed frameworks to boost EV uptake and manufacturing capacity.

Challenges to Achieving Affordability by 2025

Despite the regulatory pressure, reaching the goal of mass-market affordability by 2025 faces several challenging headwinds:

| O | Raw Material Volatility: The immediate scarcity and price increases for battery minerals, intensified by global competition (particularly from China), are currently counteracting the intended long-term cost-savings of the Batteries Regulation. |

| O | Inflationary Pressures: The current macro-economic environment, marked by high energy and labor costs, is pushing manufacturing costs up across the board, making it difficult for OEMs to absorb costs and offer steep price cuts. |

| O | Infrastructure Time Lag: Although AFIR sets 2025 targets, the gap between legislative mandates and the actual, operational roll-out of high-speed, reliable chargers in all regions introduces uncertainty that can still dampen short-term consumer demand. |

Eventually, automakers are currently caught between a dual pressure: the legislative stick of harsh CO2 compliance fines and the consumer’s resistance to high purchase prices. The EU’s approach leverages direct compliance mechanisms (CO2 targets) with long-term systemic regulations (the Batteries Regulation and AFIR) to force a structural shift. Success by 2025 hinges on the effective interplay between these ambitious legislative mandates and responsive market-based solutions. The path to the truly affordable, European-made EV remains the ultimate test of the EU’s industrial and climate policy strength.